Sterling Capital

What We Offer

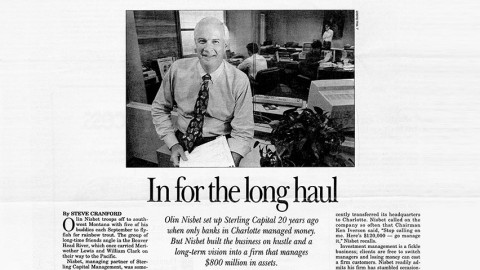

Sterling Capital is an asset manager headquartered in Charlotte, NC. We provide national sales support so you can satisfy your client’s investment objectives.

Our investment advisory services include mutual funds, separately managed accounts, model portfolios, and other commingled vehicles offered through a variety of intermediary and managed account platforms.

Six investment teams can provide you fixed income, active equity, and multi-asset solutions. We'd be happy to discuss our solutions and services in more detail.

Our Philosophy

Sterling Capital is dedicated to providing outstanding investment performance and exceptional client service

We achieve this by maintaining a consistent risk management process and a service-focused business model.

As an objectives-based investment manager, we strive to provide attractive risk-adjusted returns to the assets you place in our trust. To achieve this, our primary goal is defining and managing acceptable risk. We believe success in today’s often unpredictable markets requires equal parts experience, consistency, agility, and the ability to evaluate all the risks and opportunities inherent in a given investment.

We subscribe to the adage of “if you can’t measure it, you can’t manage it.” Over the years, we’ve found that our approach helps us deliver consistent risk-adjusted performance over time.

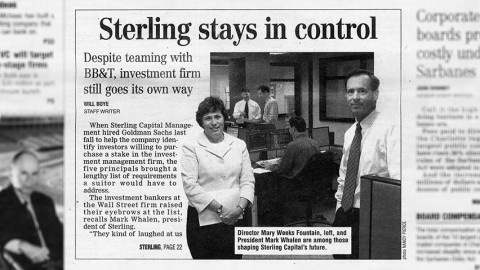

Our Team

Thought Leaders & Analysts

We are passionate about what we do, and through our close relationships with financial professionals, institutional investors, and individual investors, we’ve seen the difference our approach has made in people’s lives since 1970.

Explore