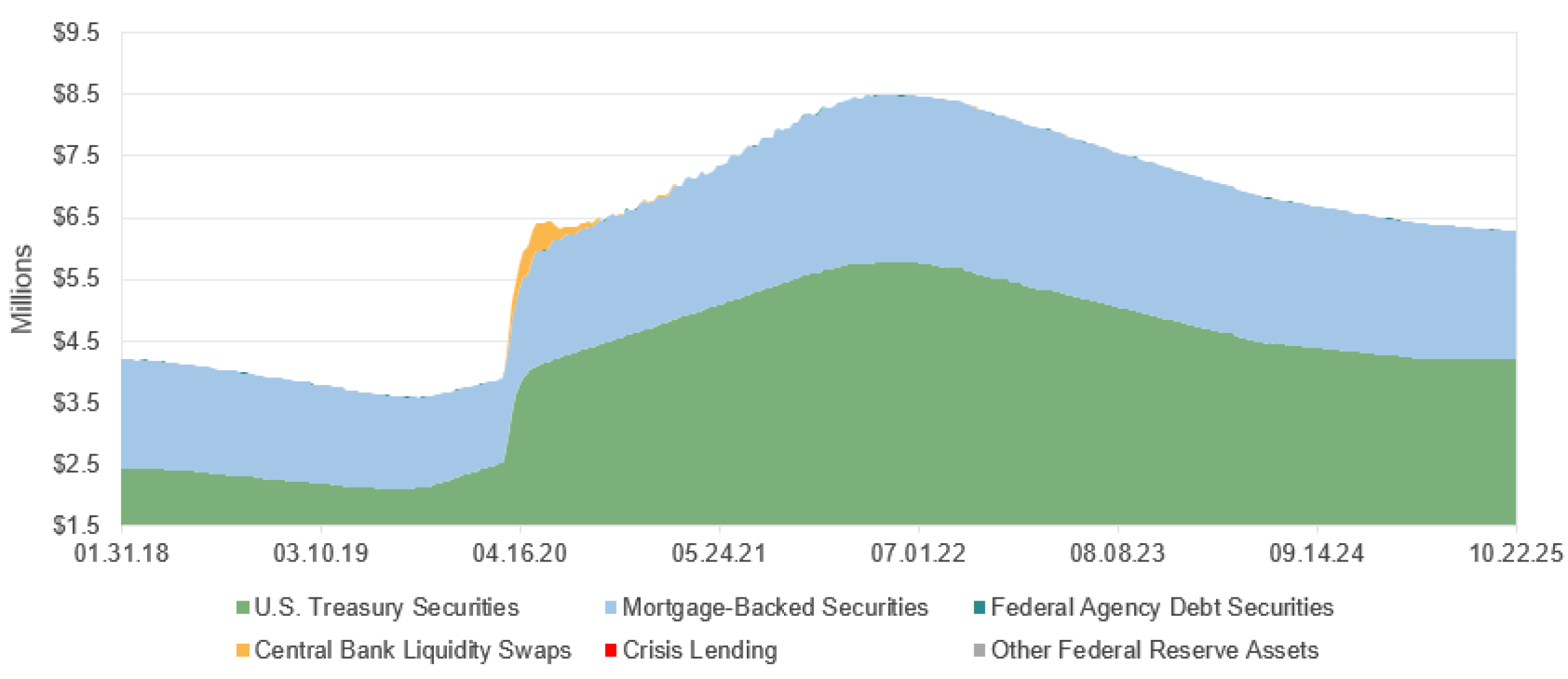

The Fed continued to lower rates again at this week’s meeting following September’s rate cut, lowering the range on the fed funds rate to 3.75%-4.00%. The Fed cited a weaker job market as job gains have slowed, and the unemployment rate has edged up. The Fed acknowledged that downside risks to employment have risen in recent months. The Fed also announced the end of their balance sheet run-off, known as Quantitative Tightening (QT), beginning December 1. The Fed’s balance sheet ballooned to over $8.6 trillion in 2022 coming out of the pandemic, but has since been reduced by more than $2 trillion, bringing the balance below $6.6 trillion, its lowest level since 2020.

During the press conference that followed Wednesday’s rate decision, Fed Chair Powell cited a challenging situation as the near-term risks to inflation are tilted to the upside and risk to employment is tilted to the downside. He further stated that the discussion within the committee was spirited, as there were differing opinions on today’s decision to lower rates with a rare occurrence of two dissents, one for a bigger cut of 50 basis points and the other for no cut. This environment of slowing growth with elevated inflationary pressures put the Fed in a data dependent mode, as Powell stressed in the press conference that a rate cut in December, which was fully priced in before today’s rate decision, was far from a foregone conclusion.

U.S. Treasury rates rose based on the resetting of further Fed rate cuts and Powell's comments on risks being balanced. The yield on 2-Year Treasuries rose ten basis points to 3.60% and the yield on 10-Year Treasuries rose to 4.06%. The market also reset rate cuts with the odds for a December cut falling to 68% from near 100% levels.

About the Author

Andrew Richman, CTFA, Managing Director, joined SunTrust in 2001 and SCM in 2020 as part of an integration following the merger of equals between SunTrust Banks and BB&T Corporation. Andy has investment experience since 1988 and is a Fixed Income Portfolio Manager and Senior Fixed Income Client Strategist. Prior to his 20 years in SunTrust’s portfolio management division, Andy ran a trust and investment department in Florida as the trust department senior manager and worked as an equity portfolio manager with Sanford Bernstein. He received his B.A. from the State University of New York at Albany and his M.B.A. with a concentration in International Business from the University of Miami. He is also a graduate of the ABA National Trust School at Northwestern University and holds the Certified Trust & Financial Advisor designation.

Related Insights

02.11.2026 • Charles Wittmann, CFA®

01.13.2026 • Charles Wittmann, CFA®

12.11.2025 • Charles Wittmann, CFA®

12.09.2025

Gregory Zage, CFA®, Justin Nicholson

The Sterling Capital VAULT: Passive Investing is NOT Static Investing