Where I’m located in the Commonwealth of Virginia, there appears to be a bounce in the step of University

of Virginia alumni as their football team is entering the Associated Press Top 25 for the first time since 2019.

It took a savvy fan to identify the potential for their favorite team to garner this impressive distinction. In a similar vein, our investment team has discussed what areas of the market appear to be overlooked and may have the ability to distinguish themselves. As with football teams that transition to greater recognition due to performance on the field, potential investments that may currently have low expectations and corresponding valuations have the potential to distinguish themselves in the market.

As active managers, we seek to combine our investment process that seeks out value opportunities with the potential for improving earnings growth through strengthening fundamentals. An area that has slowed dramatically, been in an “Ice Age” of sorts, has been the U.S. housing industry, where the increase in mortgage rates and challenged affordability has greatly lowered activity.

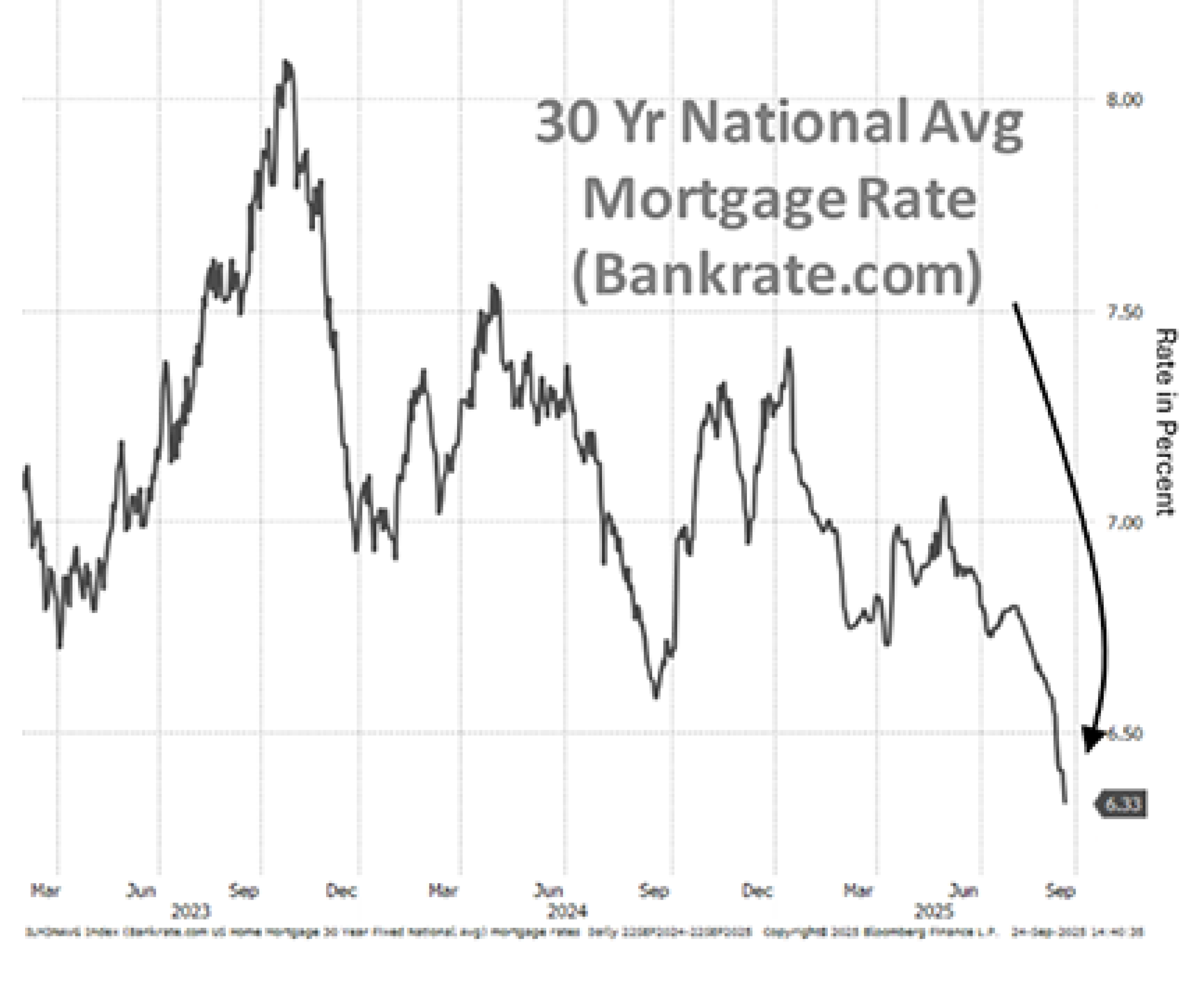

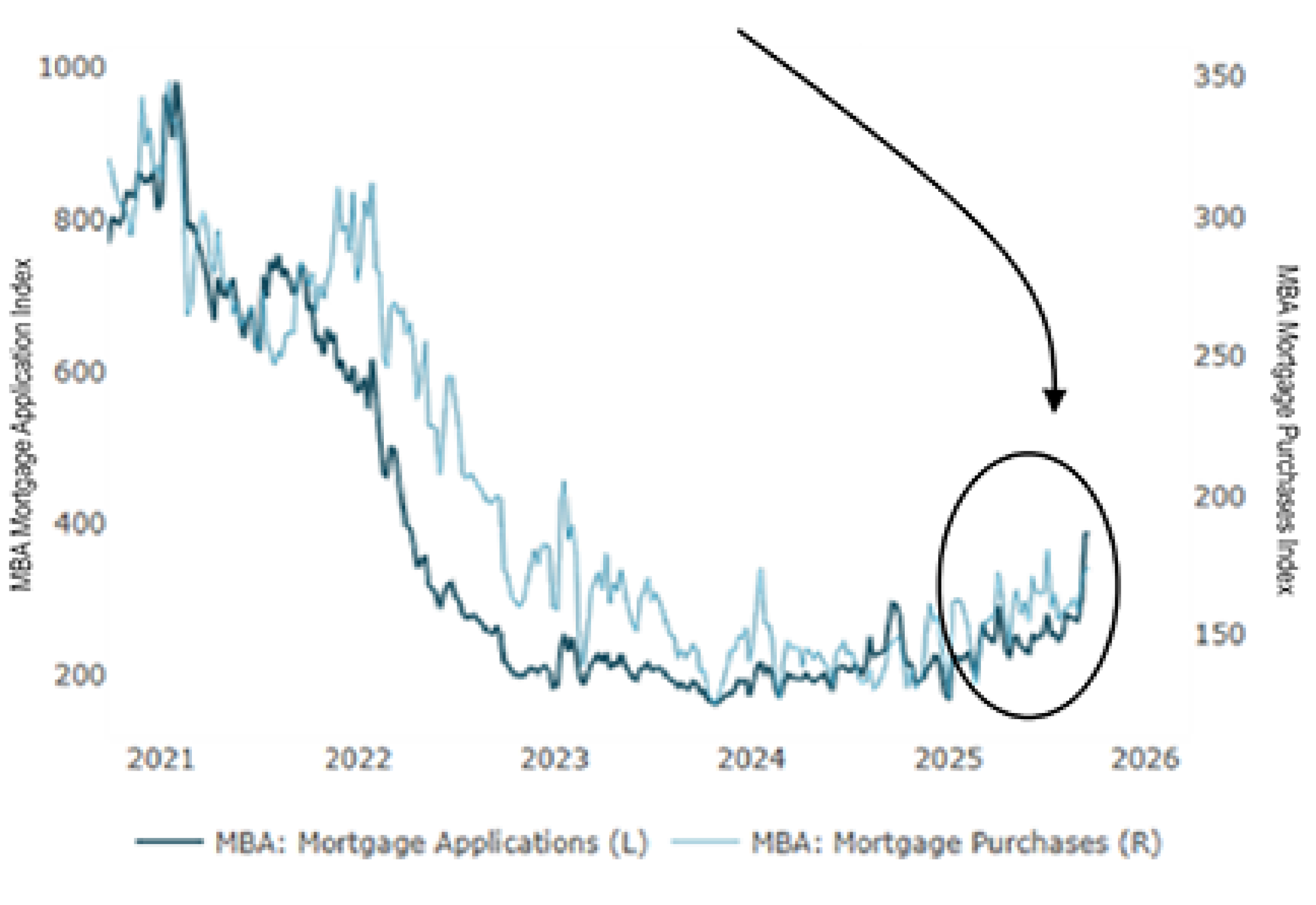

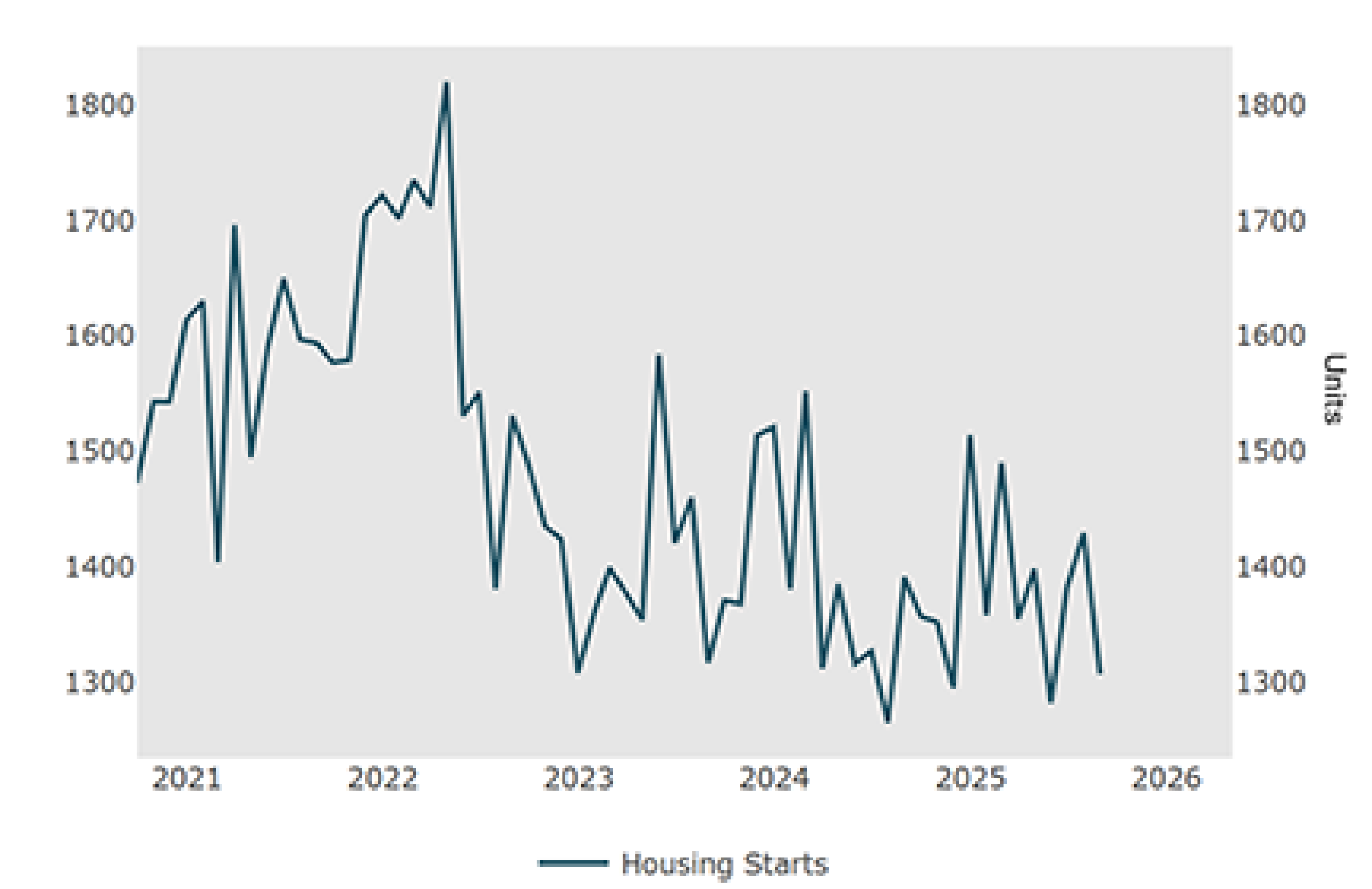

We find it interesting how this “Ice Age” in housing may be thawing, as seen in the charts above. Mortgage rates have started to decline modestly with the resumption in the Federal Reserve Funds’ rate cuts this past month, leading to the uptick in mortgage applications. Although home buying demand may be percolating, builders appear to be cautious as noted by housing starts at close to historic lows.

While there have been fits and starts in terms of housing starts over the past several years, the industry has arguably been undersupplied since 2008. According to national home builder Toll Brothers, from 2008 to 2024 in the U.S., average annual housing starts averaged 1.1 million per year versus 1.4 million or more from 1970 to 2007. With first time buyers, notably millennials entering prime household formation years, limited new construction may have left the nation in a structural supply and demand imbalance. Could lower rates improve affordability and new home sales? Lower rates may also encourage greater investment from current owners to invest in repairing and remodeling their homes. Housing may be an area of emerging thematic optionality for investors.

As always, thank you for your interest and trust managing your investments.

About the Author

Charles Wittmann, CFA®, Executive Director, joined SCM in 2014 and has investment experience since 1995. Chip is Co-Portfolio Manager of the Equity Income strategy. Prior to joining SCM, he worked for Thompson Siegel & Walmsley as a portfolio manager and (generalist) analyst. Prior to TS&W, he was a founding portfolio manager and analyst with Shockoe Capital, an equity long/short hedge fund. Chip received his B.A. in Economics from Davidson College and his M.B.A. from Duke University's Fuqua School of Business. He holds the Chartered Financial Analyst® designation and served as President of CFA Society Virginia from 2012-2013.

Related Insights

02.11.2026 • Charles Wittmann, CFA®

01.13.2026 • Charles Wittmann, CFA®

12.11.2025 • Charles Wittmann, CFA®

12.09.2025

Gregory Zage, CFA®, Justin Nicholson

The Sterling Capital VAULT: Passive Investing is NOT Static Investing